The most well-understood financial statement is the profit and loss statement. Over a stated period of time—typically, a month, a quarter or a year— the P & L tells you how the money came in and how it went out. What the P & L does not tell you is what you did with your profits and how financially strong your practice is as a result of those decisions. Your long-term financial health can be found, not on the P & L, but on the balance sheet.

What is the Balance Sheet?

The balance sheet is an accumulation of what the business owns (assets) and what the business owes (liabilities). The net difference of these two numbers is equity. Equity is a measure of the practice’s long-term financial health.

In the early days when startup expenses are typically funded by a bank loan, the practice will show negative equity. If all goes according to plan, profits will be used to eventually pay off that loan, and practice equity will grow. There will be other occasions in the life of a practice when you return to the bank to fund equipment, real estate, technology, and other practice-building assets, but your goal should always be to maintain a healthy equity position once that initial practice loan is paid down.

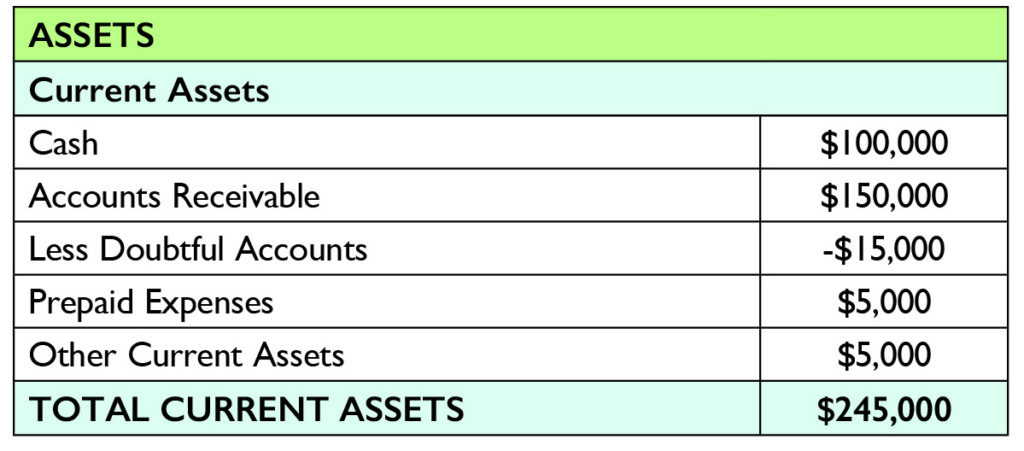

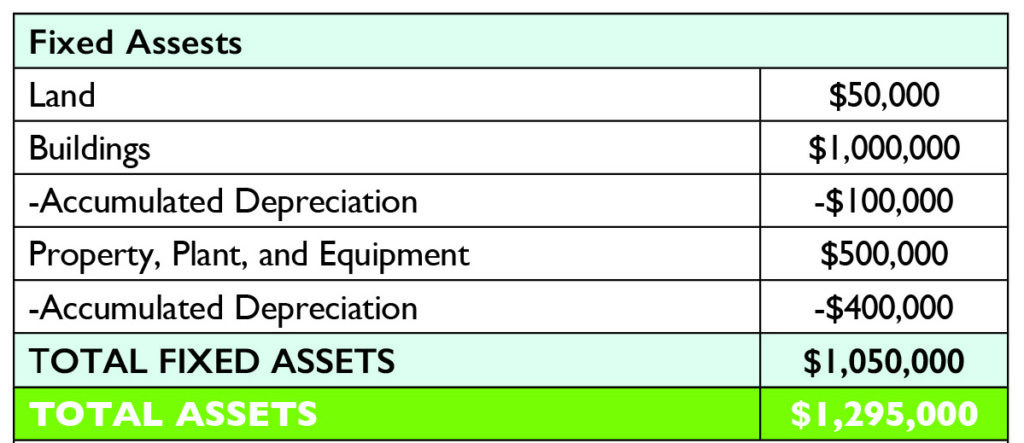

Assets

The balance sheet is broken down into current and long-term portions based on the liquidity of assets (how quickly they can be turned into cash) and the due dates of practice obligations to pay.

Cash and accounts receivable are the most active components of the current assets section. You will want to establish a minimum amount of cash to keep in the practice to weather seasonality in your production and serve as a buffer against unforeseen events. I suggest you start with one month of expenditures in the bank and adjust up or down based on your comfort level.

Accounts receivable will fluctuate based on productivity. However, you will want to monitor your payor mix and the patient balances due to ensure your staff and billing company are effectively turning these balances into cash.

The fixed assets section is a summary of the tangible assets of your practice. The amounts presented are what you paid, not what these assets are worth. Accumulated depreciation is a systematic write-down of these assets. Accounting and tax rules govern the time frame over which you write off these assets.

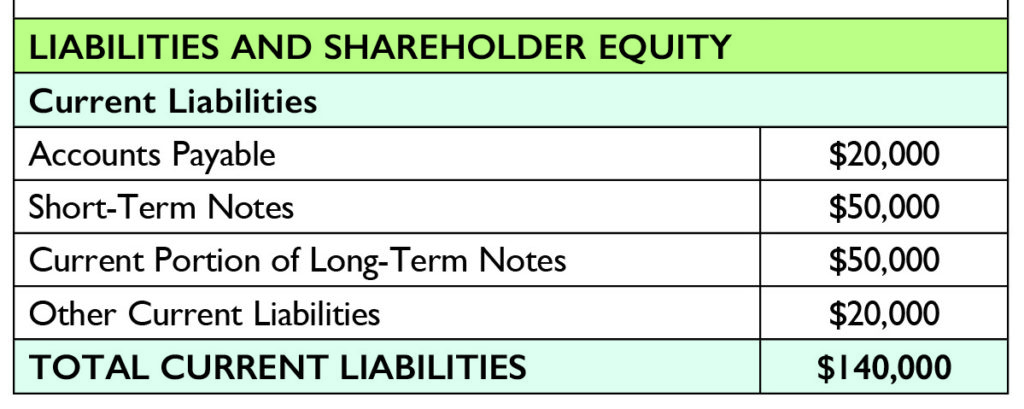

Liabilities

Current liabilities are obligations due within the next 12 months. One common measure of practice health is your current ratio, the relationship between current assets and current liabilities. If your current ratio is less than 1.0, that means that that you may have difficulty meeting your current payment obligations without an infusion of outside cash. A current ratio of 2.0 or greater suggests the practice is on firm financial footing. If the current ratio is too high, however, it may indicate the practice is too conservatively managed. In that case, there may be excess cash for owner dividends or practice reinvestment.

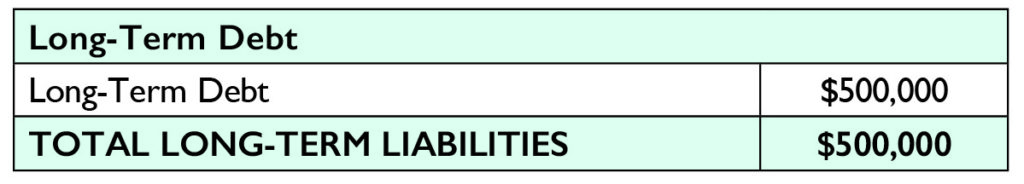

Long-term liabilities are due beyond one year. If you have a loan payable over more than one year, a common balance sheet presentation is for principal repayments due within the next 12 months to appear in current liabilities. The remainder of the loan balance will show up in the long-term liabilities section.

Equity

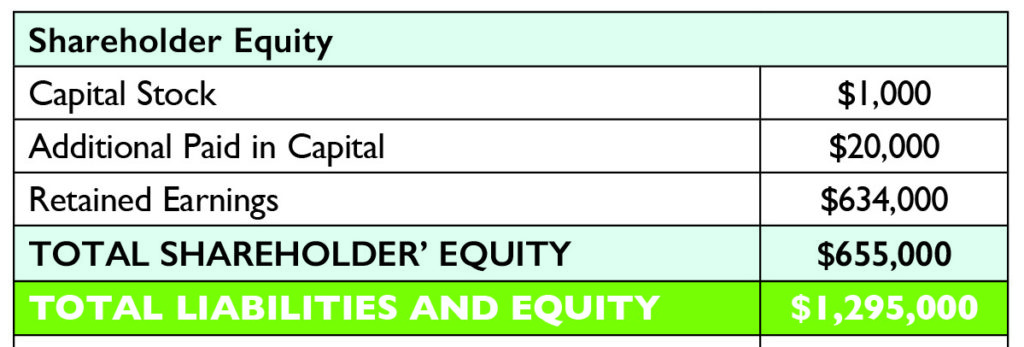

Equity is the section of the balance sheet representing the owners’ investment in the practice. It is an accumulation of initial owner investment and undistributed profits of the practice since inception. The goal of a younger practice ought to be building equity each year. When the practice matures and is relatively debt free, simply maintaining equity each year may be sufficient.

Conclusion

The profit and loss statement offers feedback on short-term practice performance. For information on your longer-term financial health, however, the balance sheet is the report you need. Getting comfortable with what the balance sheet is telling you and learning which levers to pull to improve your balance sheet will lead to a financially healthy practice.

by Trey Whitt, Partner, DentMoses, LLP, Birmingham, AL

See our blog on Effective Analysis for Practice Financials for more.

Follow us on Twitter, Facebook, and LinkedIn to join the conversation about accounting for your medical practice.

… [Trackback]

[…] Info on that Topic: smartbusinessgreatmedicine.com/basics-balance-sheet-analysis/ […]